can you buy a house if you owe the irs

However if the tax debt transitions into a tax lien this may hinder your chances of. By Denise Caldwell The good news is that the IRS has absolutely no authority over the lenders whose business it is to decide whether or not you are.

Fix Your Serious Tax Situation With Help From Community Tax The Hill

You can avoid tax liens by communicating with the.

. The short answer is yes. Consider resolving the lien with the sellers before closing the deal because buying a house with IRS debt leads to inherited outstanding payments. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage.

Yes you may be able to buy a single family house or condo in Los Angeles California or other parts. An individual can purchase a home if money is owed to the Internal Revenue Service IRS. You havent paid your taxes over the past few years and you do owe a significant amount of back taxes to the IRS.

The good news is you can buy a house even if you owe tax debt. A tax lien represents the governments legal claim. Yes you might be able to get a home loan even if you owe taxes.

When you owe back taxes the IRS has broad authority to collect. Your borrower does NOT need to pay off the entire tax debt that they owe in order to qualify for a mortgage. It is possible to buy a house if you owe taxes says Ebony J.

After that the lien becomes public record and will appear on your credit report. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate. Can You Buy a House If You Owe the IRS.

Can you get a conventional loan if you owe the IRS. Can you buy a house if you owe the IRS. Howard a certified public accountant.

Howard a certified public accountant. Can you buy a home if you owe the IRS money. The long answer is that whether you will get the mortgage has less to do with the.

You can buy houses that owe taxes but it is not advisable. Selling or refinancing when there is an IRS lien Many homeowners. It is possible to buy a house if you owe taxes says Ebony J.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Can you still buy a house. If you cant pay your tax debt it doesnt mean the IRS will automatically file a tax lien so you wont be able to purchase a home.

It is possible to buy a house if you owe taxes says Ebony J. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married. It is possible to buy a house if you owe taxes says Ebony J.

Howard a certified public accountant. Owing the IRS can lead to a tax lien Owing back taxes to the Internal Revenue Service can make the commission slap a lien on your property. However if the tax debt transitions into a tax lien this may hinder your chances of.

They can issue a tax lien against your property in order to satisfy this debt and so mortgage lenders may be hesitant to approve. However if the tax debt transitions into a tax lien this may hinder your chances of. The short answer is yes and no.

Having tax debt also called back taxes wont keep you from qualifying for a mortgage. However if the tax debt transitions into a tax. But making the process as seamless as possible will require strategic planning on your behalf.

Howard a certified public accountant. Once you get a written lien notice from the IRS you only have ten days to pay your back taxes. Can you get IRS debt forgiven.

The IRS can place a lien or levy on a home that is currently owned but the IRS is incapable of. IRS debt relief is for those with a debt of 50000 or less.

Can You Buy A House If You Owe Taxes Credit Com

What To Expect When Buying A House While Owing Taxes

How To Sell Your House If You Owe Back Taxes In St Louis Mo

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

If You Re Buying A Home This Year Whip Your Taxes Into Shape Now Real Estate News Insights Realtor Com

Get A Tax Credit For Buying A House Credit Com

Rental Real Estate And Taxes Turbotax Tax Tips Videos

Owe Back Taxes The Irs May Grant You Uncollectible Status

How To Purchase A Home When You Owe The Irs Youtube

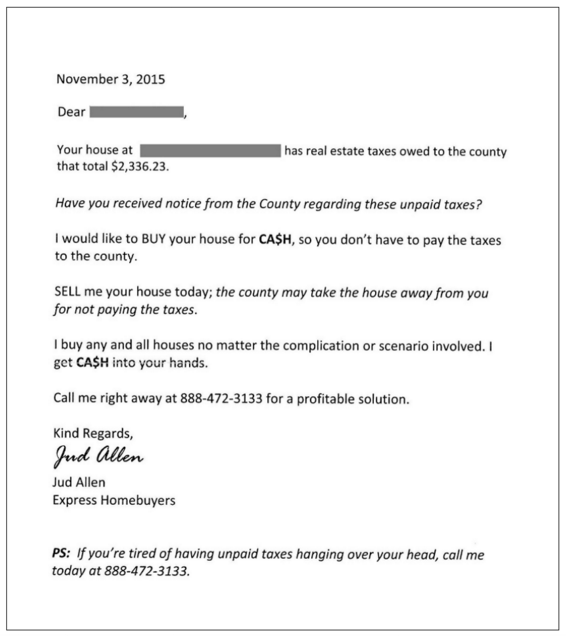

Treasurer S Office Slams False Claims In Letter From Home Buying Firm Arlnow Com

How Much Do I Owe The Irs Wiztax

You Don T Have To Pay Your Back Taxes To Get A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Can You Buy A House If You Owe Taxes Guild Mortgage Blog

Can I Buy A House Owing Back Taxes Community Tax

Buying Tax Lien Properties And Homes Quicken Loans

Myles Ma Author At The Turbotax Blog

How Much Tax Will I Pay If I Flip A House New Silver

Can I Sell My House When I Owe Property Taxes Pavel Buys Houses

Finding Out How Much You Owe The Irs For Unpaid Taxes Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829